Bookkeeping Services

Bookkeeping is the initial step in the accounting cycle where it captures all relevant financial transactions into the company’s Income Statement and Balance Sheet. Having a proper and organized accounting records is very essential regardless what size of your business is, especially for start-up or small entity that cannot afford having accounts team setup with the necessary tools hardware and software system.

With Fin Cloud you don’t have to worry about all of that as we will take care of the entire process on your behalf in a way that saves your time, money and gives you readable and organized outputs.

Fixed Assets & Inventory Management

Fixed Asset line item represents the most significant value of the balance sheet and has to be presented fairly in accordance with the accounting standards which we ensure this aspect is applied in addition to setting up relevant policies & procedures along with a full detailed list which form up the basis for choosing the most appropriate methods for the assets classifications, re-evaluations, disposals and depreciation methods.

Fin Cloud offers you the best suitable solutions for your entity’s Assets management along with establishing the controlling policies & procedures that shall guarantee a satisfactory level of administration and controlling over the assets movements and records.

Inventory management is the other hand of the current asset portfolio which covers all the saleable items as well as the consumable or spare parts that kept to be utilized upon operational needs. Putting into consideration the importance of selecting the appropriate methods to evaluate the inventory value such as FIFO, LIFO, WAC…etc based on the nature of business activity and type of the inventory items.

Our experts will help you to better plan for your inventory in order to maintain the required inventory levels, at the right time, at the right location. working with you to improve inventory cost accounting and restructure credit management in a way that reduces the value of the inventory that takes part of your working capital that would eventually support your cash flow position.

Receivables / Payables Monitoring & Control

Accounts Payables: Monitoring liabilities (i.e. Outstanding balances) to maintain stability in the overall spending of the company can be achieved thru applying mutual credit terms.

Accounts Receivables: describes amounts collectible by the company against goods/services rendered to its client. And to monitor such critical area it’s strongly recommended to have a close monitoring and follow-ups to ensure the mutual contract between the parties with the agreed terms and condition is applied and the dues settlement plan is according to the credit terms given.

To wisely manage your business cash flow, you need to make sure first that you are collecting the cash you merit for the good or services you sold within the minimum DSO number (Days Sales Outstanding), simultaneously that you’re paying your suppliers when you should be paying them according to the agreed payment terms taking into consideration the benefit of any possible discounts.

Payroll Management

With the increase in competition among business enterprises. Human Resources are considered to be the most important part of any company. It is said that if any company has a Human Resource then it will definitely have many advantages. This is the reason why the importance of the HR Department is increasing day-by-day. With the continuous advancement in the latest technologies, the management of employees and their records have become tough to handle. To prevent this, many companies have linked their payroll system with the HR activities which is called as Payroll Management Software.

Sensitive personnel data control will result accurate / proper financial representation in your month / year end. As such control will facilitate mostly employee performance measurement and ways to optimize existing processes.

Balance Sheet Reconciliations

In fact, having a clean and fairly presented Balance Sheet reflects a solid financial position of the firm and the level of control and tracking of exposures taken care by the company Accounts and Management.

Balance sheet gives you insight into where your business stands financially. But, you won’t get an accurate picture of your company’s financial position if you don’t maintain a regular balance sheet reconciliation preparation and review.

Our specialists will ensure a timely & continuous item-wise balance sheet reconciliation are maintained for your business along with action plan to clean up any irregularities which warrant a high level of assurance to management and clear the decision path towards overall goals & objectives.

Working Capital Enhancement

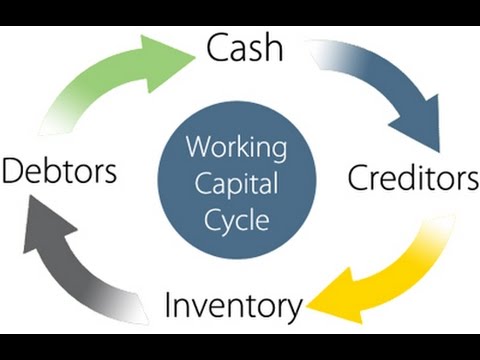

Fin Cloud helps its clients to sustain an efficient working capital position and facilitate release of cash to fund additional growth plans. An efficient working capital management program includes; robust systems, streamlined processes and management precision with respect to costs and controls resulting in release of cash. Improving cash operating cycles by reducing float in various finance processes and by building frameworks for effective cash forecasting.

What is in it for you?

- Facilitate additional growth with existing working capital

- Optimization of the company’s cash

- Procurement, accounts payable, inventory, and collection process improvement

- Reduce debt exposure and manage cost of capital

- Improved visibility and reliability of information and establishment of continuous control.

Cash Flow Management

Basically, we will be assisting in managing the company’s cash needs with the proper financing sources & allocate it to the proper spending channel which best serves the overall goals.

Mostly top management is very much concerned with their company’s cash position that assists the ongoing operation stability as well as future expansion plans, but running out of cash is a stop station where it indicates serious weakness in the flow of liquid cash. In a simple statement “If your business constantly spends more than it earns you have a cash flow problem”.

With such situation Fin Cloud will guide your concerned team to implement strategy and plan to enhance customer collections & prioritize cash spending. Also if cash is managed properly will assure the best technique is being used to sustain business cash needs.

ERPs Setup And Implementation

ERP serves the ultimate weapon that every business uses to penetrate the market as it’s a reflection of your business stand point where you can determine the next action plan. Also it’s essential to invest in a strong ERP system that assures high level of control & segregate the duties between respective employees.

We at Fin Cloud will always advise / recommend the best ERP solutions that best fits the nature and size of your business. Working with your team side by side during the implementation & set-up stage.

Business Plan Preparation And Development

It is more of Analysis that can help anticipating any challenges you may face and help you overcome them. It can also assist in setting up the goals for your business, financing strategies, market share diagnosis. Nevertheless any plan is subject to amendment & updates based on recent market development and it’s mandatory to adopt the plan in order to support the company growth within the challenges faced.

Fin Cloud expertise leadership will assist business management to draw the guidelines and formalize the best scenario of action plans that mostly suits the owners to achieve their goals, further it is Fin Cloud’s responsibility sharing all market developments / updates that will ease the build up of such plan to smoothen final accomplishments.

Accounting Services

With your data entered into the system and have all the numbers generated from the company transactions and documents, the next step is to present such data in a way that can help management making decision and better understand the business financial position.

Fin Cloud Team can help you managing a smooth periodic financial closure, the Profit/Loss analysis and the periodic financial reports that demonstrate the company profitability and cash flow position.

Moreover, preparing and reviewing the Balance Sheet accounts, including bank, reconciliations in order to maintain clean books and keep your Balance Sheet free from any potential exposures.

With Fin Cloud you will have the flowing areas properly managed:

- Fixed Assets Management.

- Inventory Management.

- Cash flow management.

- Accounts Receivables & collections.

- Accounts Payable.

- All Balance Sheet accounts and Bank Reconciliations.

Fixed Assets Management

It is very crucial to have a proper accounting process set up for the company fixed assets management system to help to track your fixed assets and achieve many purposes such as financial accounting, preventive maintenance, and misuse prevention.

This process helps to manage every aspect of a company’s fixed assets, from the moment an asset is acquired to its ultimate disposal. It also enables maintaining detailed asset records and references of your company’s valuable properties which enhances the visibility and control.

Fixed Assets Management helps you to know where a particular asset is in its lifecycle at any point of time and evaluate whether or not it’s still adding value to your business.

Usually, the Fixed Asset line item poses the most significant value of the balance sheet and has to be presented fairly in accordance with the International Accounting Standards in which we ensure a full compliance is firmly applied in addition to setting up relevant policies & procedures that organize and control all the respective transactions.

Fin Cloud with its expertise offers a comprehensive review and assessment for your current Fixed Assets Management System, accordingly set up the most appropriate process along with the relevant set of Policies & Procedures that gives you the visibility and overall control over your fixed assets and properties.

Inventory Management

The wise Inventory Management means having effective internal controls over inventory in place throughout a process set up to ensure that the company constantly has the products it needs for its operations on hand, safeguarding the inventory, track its movements, conduct physical counts and maintain the associated cost at its lowest levels.

Inventory management makes its remarkable score on the inventory line item of the balance sheet. That line item reflects the cost of the inventory with all the associated costs directly or indirectly incurred including the purchase price as well as the freight, inspecting, storage, maintenance, insurance, customs, taxes, and other costs associated with the purchasing process.

Inventory management is a key element of the cost of goods sold, accordingly a key driver of the final profit and total assets figures.

Many financial ratios, such as the inventory turnover, incorporate inventory values to measure and evaluate certain aspects of the health of any business.

Inventory management defines the suitable inventory valuation method that fits the company business structure among the common accounting methods such as; "first-in, first-out" (FIFO), "last-in, first-out" (LIFO), Weighted Average Cost (WAC), and lower of cost or market (LCM).

Considering the significant costs and benefits associated with inventory, companies usually put a lot of efforts and time in calculating the optimal level of inventory to keep at any given time.

Fin Cloud team can help you building an effective Inventory Management System, setting up the appropriate inventory valuation method and applying the suitable inventory-control model that fit your operations and business requirements.

Working with you to improve inventory cost accounting, determine the optimal levels of inventory and restructure credit management in a way that reduces the value of the inventory that takes part of your working capital accordingly enhance the company’s cash flow position.

Cash Flow Management

Basically, we will be assisting in managing the company’s cash needs with the proper financing sources & allocate it to the proper spending channel which best serves the overall goals.

Mostly top management is very much concerned with their company’s cash position that assists the ongoing operation stability as well as future expansion plans, but running out of cash is a stop station where it indicates serious weakness in the flow of liquid cash. In a simple statement “If your business constantly spends more than it earns you have a cash flow problem”.

With such situation Fin Cloud will guide your concerned team to implement strategy and plan to enhance customer collections & prioritize cash spending. Also if cash is managed properly will assure the best technique is being used to sustain business cash needs.